If you need to understand the differences between Paytm Money Vs Groww, reading this post till the end will provide you with the essential clarity. I have done a thorough analysis of the two services, and I would love to walk you through my findings.

In this post, I will explain various crucial aspects of the two discount brokers, including the account opening process, trading applications, fees and charges, support, and pros and cons.

Paytm Money Vs Groww: Overview

Paytm Money is a SEBI-registered trading and investing platform incorporated in 2017. The trading platform is owned by One97 Communications Ltd, the same company that owns Paytm. The platform allows you to invest in Equity trading, IPO investment, ETFs, digital gold, and F&O.

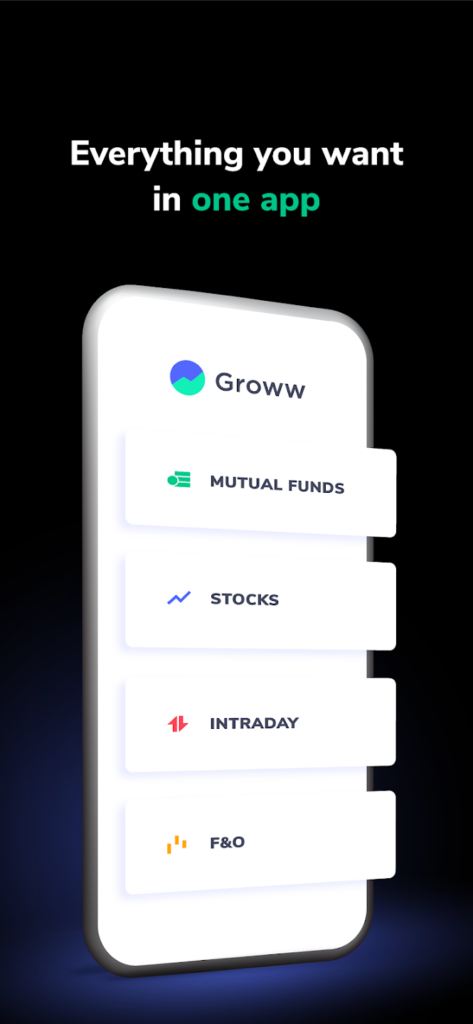

Groww is a Bengaluru-based discount broker established in 2016. The platform is SEBI registered and follows a flat-free discount brokerage model. Back when Groww started, it was just a direct mutual fund investment platform. However, over the years, the company has expanded its services, and now it offers a variety of trading and investment options comprising Equity, F&O, Mutual Funds, US Stocks, Digital Gold, and Corporate FD.

Paytm Money Vs Groww: Account opening process

The account opening process is similar for both platforms. Here are the essential steps to follow:

- Visit the official Paytm Money website or Groww Website of the discount broker and enter your mobile number

- Next, complete your mobile verifications using OTP

- Besides, you will need to complete an email verification

- After that, you will need to complete your KYC verification

- You need to have an Aadhaar card, Aadhar-card linked sim, and PAN card handy for that

- You will need to fill in some personal details like occupation, income, trading experience, etc.

- After that, you can verify your KYC through DigiLocker

- Next, you will need to complete your IPV, which stands for In-Person Verification

- The IPV basically requires you to create a 5-second video of yourself introducing yourself

- In the last step, you need to eSign your application by getting to the NSDL portal

- Once you get there, you will need to enter your Aadhar number and verify it using the OTP you receive to your Aadhar-linked mobile

Paytm Money Vs Groww: Trading Platforms

Trading applications play a crucial role in trading. It’s time to look into the trading applications of the two platforms.

Paytm Money Trading Platforms

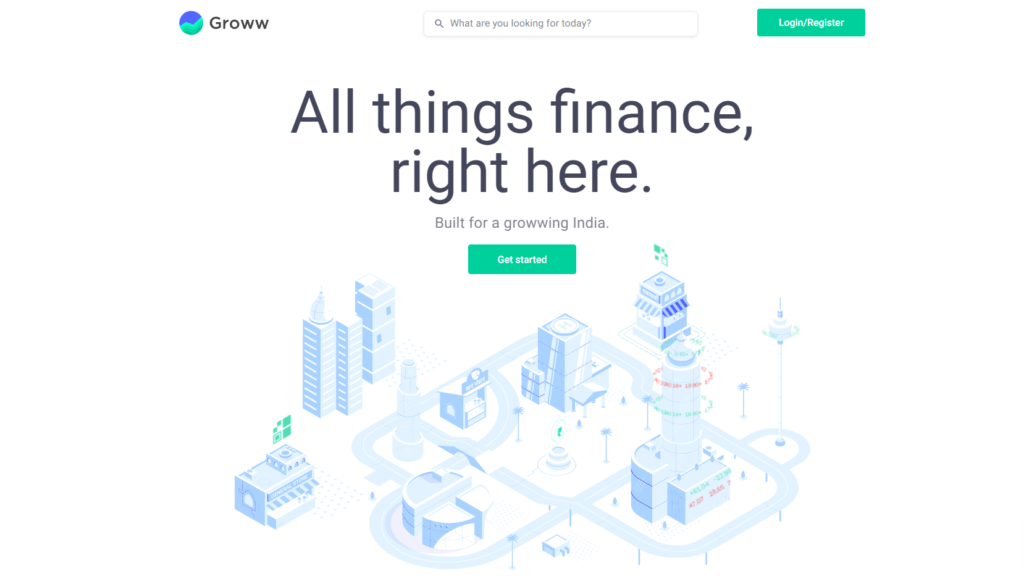

Paytm Money Web App

Paytm Money has a web-based trading terminal for PC and laptop users. The application is equally suitable for trading and investing. Order placement is fast. Besides, you can effortlessly track your positions. Users have the option to choose between Tradingview and ChartIQ charts. The app offers multiple order types (Bracket Order and Cover Order), multiple indicators and timeframes. Further, the application comes with good fundamental analysis data and tools. Even mobile users can use the web app from their mobile browser if they don’t want to install the mobile app.

Paytm Money Mobile App

If you are one of those people who are more comfortable with trading from a smartphone, the Paytm Money Mobile App is the ideal option for you. The Paytm Money Mobile App is available on App Store and Play Store. The app is exceptionally secure, backed by the latest encryption and two-factor authentications.

The app comes with advanced charts, drawing tools, and indicators. Besides, the app comes with live market depth, simple payment options, and customized watchlists. Further, the app comes with multiple investment options, price alerts, and notifications.

Groww Trading Platforms

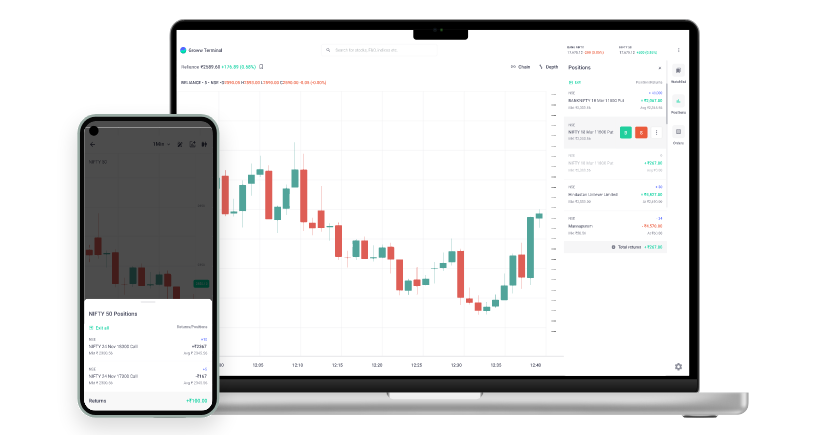

Groww Web App

Groww Web App is ideal for PC and laptop users. The app comes with excellent fundamental and technical analysis tools. The web app comes with Tradingview and ChartIQ charts. The interface is intuitive, and order placement is smooth. The application is good for both traders and investors. Besides, you can capitalize on multiple indicators, timeframes, and order types. One thing that gives Groww an edge over other trading platforms is its fundamental and financial analysis data for different stocks. It's easy to understand and highly valuable for investors.

Groww Mobile App

Groww Mobile App is a secure trading app for mobile users. The app is available on Android and iOS. The app works flawlessly on smartphones and has all the essential features for trading and investing.

You can choose between Tradingview and ChartIQ charts to plan your trades. Further, you can make the most out of Groww’s fundamental analysis data.

Paytm Money Vs Groww: Fees and Charges

Paytm Money Fees and Charges

Paytm Money charges ₹200 for account opening, and there are no Demat Account Annual Maintenance charges.

Regarding the brokerage charges, Paytm Money charges minimal brokerage charges lower than other discount brokers. Here are the brokerage charges:

- ₹15 per executed order or 2.5% of turnover, whichever is lower on Equity Delivery

- ₹15 or 2.5% of turnover, whichever is lower on Equity Intraday

- ₹15 per executed order or 0.02% of turnover, whichever is lower on F&O

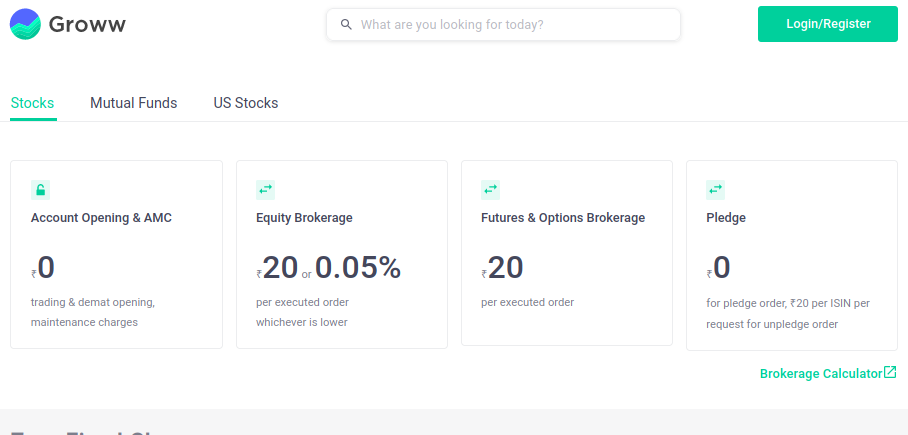

Groww Fees and Charges

Groww allows you to open an account for free. Besides, the platform doesn’t charge any AMC.

It’s time to look at Groww’s brokerage charges. Here are the brokerage charges:

- ₹20 per trade (or 0.05%, whichever is lower) on Equity Delivery

- ₹20 per trade (or 0.05%, whichever is lower) on Equity Intraday

- ₹20 per trade on Equity F&O

Paytm Vs Groww: Investment options

When it comes to investment options, both platforms have a similar range of investment options. Both platforms offer investment options such as Mutual Funds, IPOs, Digital Gold, and NPS. However, Groww has a leading edge over Paytm Money since it also allows users to invest in US Stocks.

Paytm Money Vs Groww: Support

Whenever you run into a technical issue in the middle of your trading session, good customer support can help you break out of it faster. Hence, looking at the customer support of the two platforms is essential.

Paytm offers reliable support through tickets and, besides, has good FAQs for quick reference. Groww is similar to Paytm Money in terms of customer support and follows almost the same model with technical assistance through tickets. However, Groww has categorically arranged documentation for all the technicalities for quick reference. I strongly feel the platforms should consider offering live chat assistance since ticket assistance usually takes about 10 to 15 minutes, and in trading, every minute counts.

Paytm Money Vs Groww: Pros and Cons

Paytm Money Pros

- Various financial products to invest in

- Reliable trading applications

- Advanced charting tools

- Simple and low trading charges

- Multiple order types

- Extra 1% returns on Direct Mutual Funds

- Online IPO application

- Advisory services on Mutual Fund Investment

Paytm Money Cons

- Good Till Canceled order is not available

- Equity Delivery is not brokerage-free

- No Commodity and Currency trading facility

Groww Pros

- No account opening charges, and AMC

- Flat ₹20 per trade brokerage

- Option to invest in US Stocks and Digital Gold

- Online IPO application is allowed

- An extra 1.5% returns on Direct Mutual Fund investments

- Highly usable trading applications

Groww Cons

- Advanced orders like GTT orders are not available

- No Commodity and Currency segments

- No Call and Trade services

Conclusion

I have explained the various essential aspects of the two platforms in this post. As you have seen, Paytm and Groww are pretty similar in terms of features. Both platforms are reliable for trading and investing. However, Groww has certain advantages over Paytm Money. First, it doesn’t charge you anything for account opening. Besides, it doesn’t charge you any AMC. Further, Groww allows you to invest in US Stocks, which is undoubtedly a big advantage.