In this post, I am going to walk you through the essential details about the two leading trading and investment platforms – ICICIdirect vs HDFC Securities. It will include their trading applications, fees & charges, investment options, support, and pros and cons.

ICICIDirect Vs HDFC Securities – Introduction

Both ICICIdirect and HDFC Securities follow a 3-in-1 account model. ICICIdirect is a subsidiary of ICICI Bank and was launched in 2000 by ICICI Securities.

ICICIdirect is undoubtedly a reliable platform in India and has won many prestigious awards over the years.

HDFC Securities is a SEBI-registered broker and a subsidiary of HDFC Bank, founded in 2000. The platform is seen as a safe and trusted broker in India.

ICICIDirect Vs HDFC Securities – Trading Applications

The next thing you must be wondering is whether they have reliable trading applications. It wouldn't be wrong to say that ICICIdirect has excellent trading applications across desktop, mobile, and web. Most importantly, the platform allows customers to use these apps for free. The apps come with real-time price alerts, research notifications, and alerts on Portfolio stocks. ICICIdirect trading applications provide users with the option to switch between ChartIQ and Tradingview charts.

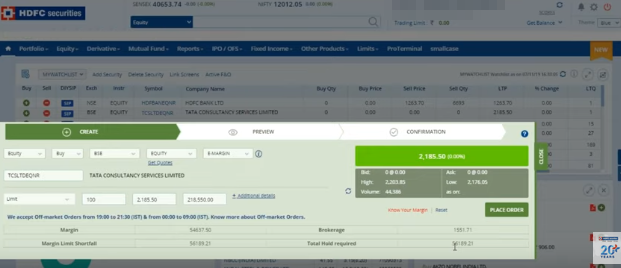

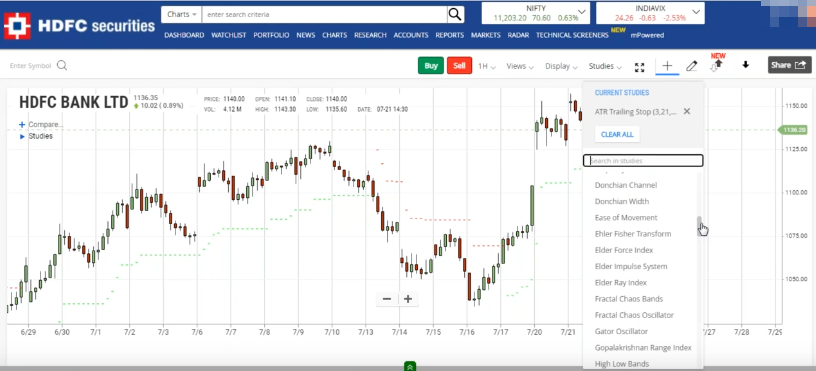

HDFC Securities has trading applications across mobile, desktop, and web. The apps come with features such as live market news and data, notifications, and investment tracking. While HDFC Securities' mobile and web applications are offered for free, the desktop application, Pro-Terminal, is a paid application. The Pro-Terminal is available for an annual fee of ₹1,999. Regarding usability, the apps are pretty smooth, and order execution is fast. HDFC Securities' applications come with ChartIQ charts.

ICICIdirect vs HDFC Securities – Fees & Charges

It's time to discuss the fees and charges of the two platforms. ICICIdirect doesn't charge any fee for account opening. The platform charges an Annual Demat Account Maintenance fee of ₹300. However, it doesn't charge any AMC fee for the first year.

Next, it's essential to look at the brokerage charges of the platform. Here are the brokerage charges of ICICIdirect:

- Equity Delivery: 0.55% irrespective of turnover

- Equity Future: Free

- Equity Intraday and Equity Options: ₹20 per executed order

- Currency and Commodity F&O: ₹20 per executed order

HDFC Securities charges an account opening fee of ₹999 and an Annual Maintenance charge of ₹750. The brokerage charges of the platform are as follows:

- Delivery-based trading: 0.50% or min ₹25 or ceiling of 2.5% on transaction value (Both Buy & Sell)

- Square-off trades cash & carry scrips: 0.10% or min ₹25 or ceiling of 2.5% on transaction value (Both Buy & Sell)

- Square-off trades margin scrips: 0.05% or min Rs 25 or ceiling of 2.5% on transaction value (Both Buy & Sell)

- Non-Square Off (Carry Forward) Trades (Future Market): 0.05% or min Rs.25/- or ceiling of 2.5% of the transaction value (Both Buy & Sell)

- Square-off trades (Future Market): 0.025% or min Rs.25/- or ceiling of 2.5% of the transaction value (Both Buy & Sell)

- Option Market: Higher of 1% of the premium amount or Rs.100 per lot (Both Buy & Sell)

Investment Options

Next, it's time to find out your investment options with these platforms. ICICIdirect offers customers a wide range of financial products for investment and trading. These include equity, Mutual Funds, IPO, Fixed deposits, Bond, NCDs, wealth products, F&O, Currency, and Commodities.

HDFC Securities allows customers to trade and invest in various financial instruments, comprising shares, bonds, futures, options, mutual funds, IPOs, and currency derivatives. However, the platform doesn't have the commodity trading feature yet. Hence, if you are looking for a trading and investing platform for the commodity segment, there are more suitable options than HDFC Securities.

Research & Analysis Tools

Regarding research and analysis, customers can undoubtedly find a lot of help from ICICIdirect. The platform has many handy tools like Market App, i-Track, One Assist, and different calculators. Besides, the platform offers excellent fundamental and technical analysis data. HDFC Securities provides customers an outstanding market overview with top gainers and losers, 52-week high and low, and Open Interest Analysis.

Support

When it comes to customer support, both ICICIdirect and HDFC Securities do an exceptional job. ICICIdirect offers users technical assistance through live chat, phone, and email, while HDFC Securities addresses customers' technical issues and queries through live chat, email, and phone. It's worth mentioning that HDFC Securities allows you to contact live chat support without leaving your trading terminal. I found it extremely helpful in the initial days of my trading journey. Further, both ICICIdirect and HDFC Securities have excellent online tutorials and knowledge base.

Pros & Cons

ICICIdirect Pros

- Account opening is free and completely paperless

- The 3-in-1 account model makes deposits and withdrawals exceptionally convenient

- Excellent trading applications across all device platforms

- Advanced order types like VTC (valid till canceled)

- Reliable and quick technical support through live chat, phone, and email

ICICIdirect cons

- Brokerage charges are comparatively higher than other discount brokers

HDFC Securities Pros

- The 3-in-1 account model offers users excellent convenience

- Wide range of investment and trading products

- Highly usable trading applications across all device platforms

- Good research and analysis tools

- Exceptional technical support through live chat, phone, and email

HDFC Securities Cons

- High account opening fee and AMC

- High brokerage charges

- Desktop application is not free

Conclusion

I have provided you with every detail of the two trading platforms. As you have seen, both the platforms have been around for a long time and are pretty reliable. If we compare, HDFC Securities has higher brokerage charges than ICICIdirect. Besides, the account opening charges in HDFC Securities are quite high, while it's free in ICICIdirect.

Further, HDFC Securities has a comparatively higher AMC than ICICIdirect. As far as customer support goes, both the platforms do a commendable job. I will recommend ICICIdirect over HDFC Securities.