Are you planning to try ICICIdirect in 2024? If so, you will find this post extremely useful. I will provide you with clear information on the trading and investment platform.

In this post, I will discuss the company's track record, including its services, pricing, support, and salient features.

ICICIdirect Review – Background

ICICIdirect, or ICICI Securities, is a subsidiary of ICICI Bank Ltd and a SEBI-registered trading and investment platform. ICICI Bank has been around since 1995. ICICIdirect is a platform for both retail and institutional investors. The platform has earned many awards over the years. Some of the awards are:

- Retail Broker of the Year in 2019

- iNFHRA Workplace Excellence Award in 2020

- Big Bang Awards for Media and Wellness Bronze Award

- Corp Com & PR Excellence Awards for the Best Annual Report of the Year

- Outlook Business Retail Broker of the Year 2021 Gold

- Digital Wealth Manager of the Year India by The Asset Triple A, Digital Awards, 2021

- National CSR Award in Financial Services By Global Safety Summit Awards in 2022

Features at a Glance

- ICICIdirect comes with a 3-in-1 account model

- ICICIdirect allows customers wot open an account at zero charges

- The platform charges an Annual Demat Account Maintenance charge of Rs 300 per year

- ICICIdirect offers four types of brokerage plans

- ICICIdirect applications are available across the web, desktop, and Mobile platforms

- Flat Rs. 20 per trade brokerage in Options, Currency F&O

- The platform offers products including Equity, Mutual Funds, Futures and Options, Currency, Commodity, ETF, Insurance, IPOs, Corporate Fixed Deposits, and Loans.

Services

ICICIdirect is a trading and investment platform with over 80 lac customers. The platform provides customers with over 50 products and services comprising Equity, Mutual Funds, Futures and Options, Currency, Commodity, ETF, Insurance, IPOs, Corporate Fixed Deposits, and Loans. Besides, ICICIdirect has an award-winning research team. The platform also offers customers many advanced research tools such as SWOT Analysis, i-lens stock screener, Rapid Results, Regular Blogs, and Weekend Reads.

Trading Platform

It’s time to talk about the ICICIdirect trading application and experience. ICICIdirect is an All in 1 for trading and investment. The app is available on the web, desktop, and mobile platforms. Besides, customers can use the ICICIdirect Markets app and the iLearn app. The trading application is easy to use. If I compare it to leading trading applications like Zerodha or Upstox, ICICIdirect is equally intuitive.

Fees & Charges

Next, we look into the brokerage fee and charges of ICICIdirect. The platform has zero charges on account opening. Besides, it doesn’t charge AMC for the first year. However, for the second year onward, the platform will charge an AMC of Rs 700 per year. Fund transfers are absolutely free of any charge.

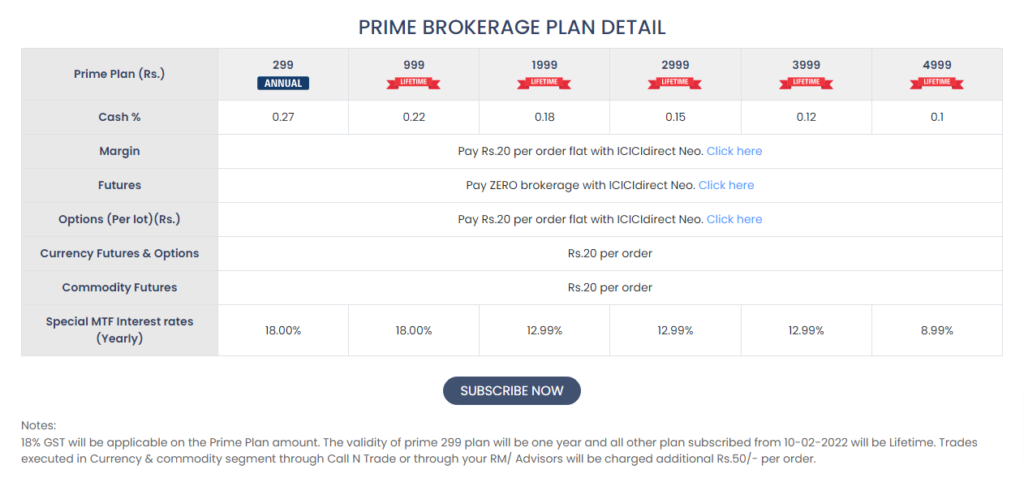

As far as the brokerage goes, ICICIdirect has four plans: ICICIdirect Prime, ICICIdirect Neo, Prepaid Brokerage, and I-Secure. The Prime plan has six different annual and lifetime pricing options. The Annual plan costs 299, and the charges are 0.27% on Cash and Futures, Rs 40 on Options per lot, and Rs 20 on Currency & Commodity per order. Lifetime plans start as low as 999, and the charges are 0.22% on Cash and Futures, Rs 35 on Options per lot, and Rs 20 on Currency & Commodity per order.

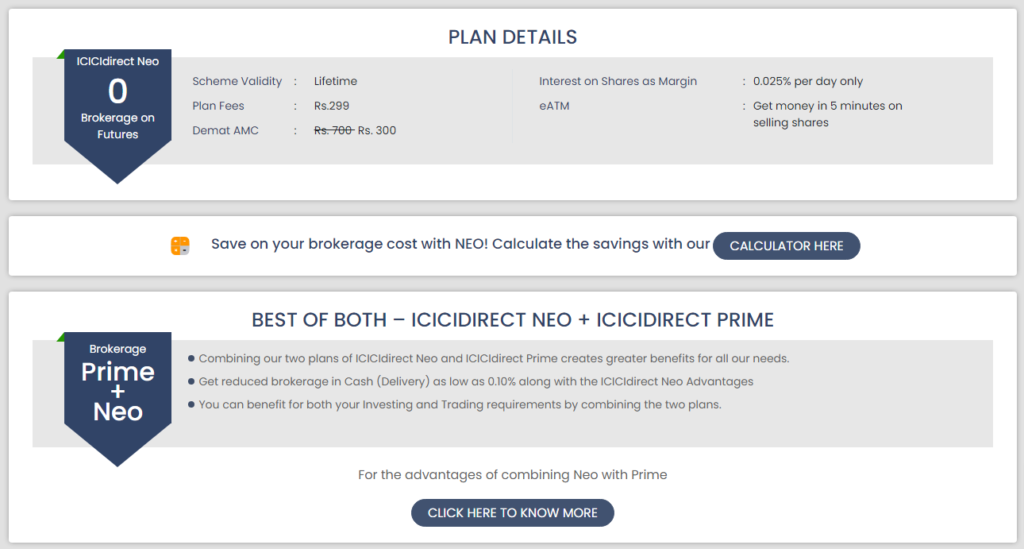

ICICIdirect Neo plan brokerage goes like this: zero charges on Futures, Rs 20 per order on Options, Rs 20 per order on Margin, Rs 20 per Order on Currency F&O, and Commodity F&O. ICICIdirect Prepaid Brokerage Plan has six innovative Lifetime plans. Customers can start for as low as Rs 2,500, and once you choose this plan, your brokerage will be: 0.25% on Cash and 0.025% on margins and Futures. Brokerage on Options will be Rs 35 per lot, and that on Currency and Commodity will be Rs 20 per order.

If you choose the ICICIdirect I-Secure Plan, the brokerage is 0.55%. The brokerage for Margin and Margin Plus will be 0.050%. For transactions up to Rs 50000, the minimum brokerage will be Rs 25 or 2.5%, whichever is lower. Brokerage for Equity Futures is 0.050%, and that for Equity Future and Future Plus is Rs 50. Brokerage in Currency Futures & Future Plus Stop Loss is Rs 20 per Order.

Commodity Futures will have a brokerage of Rs 20 Per Order. For options, the brokerage will be Rs 95 flat brokerage per contract lot and Rs 50 on the Second leg of Intraday square-off per lot. The brokerage on currency options and commodity options is Rs 20 per order.

Customer Support

ICICIdirect has impressive customer service. The platform has an advanced bot to address the basic queries of the customers. Besides, customers can request a call. Further, customers can use the Live Assistance feature to chat with an ICICIdirect officer or call the customer care number directly.

You can also email the ICICIdirect helpdesk with any query or issue. ICICIdirect also has a Whatsapp account for the customers, and to start a chat, you have to send hi to 9833330151. Further, ICICIdirect has various online learning materials for customers, including articles, blogs, podcasts, webinars, videos, and more. It wouldn’t be wrong to say that ICICIdirect has the most comprehensive customer service in the industry.

FAQs

Can we trust ICICIdirect?

ICICIdirect is a SEBI-registered platform and a subsidiary of ICICI bank, which has been around since 1995. Besides, the platform has won many prestigious awards over the years. The platform is ideal for both trading and investment since it offers many products and services.

The ICICIdirect app is an excellent all-in-1 app for trading and investment. You can access it on desktop, web, and mobile platforms. Last but not least, the platform has excellent customer service.

Is ICICIdirect Demat Account free?

Opening an ICICIdirect Demat Account is absolutely free. However, ICICIdirect has four plans. You may have to pay additional charges when you choose a particular brokerage plan. As far as AMC goes, the platform doesn’t charge any AMC for the first year, and AMC will be only charged from the second year onward at Rs 700.

What are the different products that ICICIdirect offers?

ICICIdirect offers a wide range of products, and some of these products are Equity, Mutual Funds, Futures and Options, Currency, Commodity, ETFs, Insurance, IPOs, Corporate Fixed Deposits, and Loans.

Conclusion

While ICICIdirect is a reliable trading and investing platform, the charges are comparatively higher than discount brokers like Zerodha or Upstox. However, if you think the platform has the right features for you, you can lower your brokerage charges by going for the right ICICIdirect plan. As you can see in this article, ICICIdirect has various plans to lower brokerage charges.

Besides, with ICICIdirect, you have the advantage of opening a 3-in-1 account, and of course, you have an excellent customer support team always by your side to assist you.