If you are looking for some clarity on how to use Tickertape to invest in the share market, this is the post for you. In this article, I will explain the essential features of Tickertape and how you can make the most out of them for profitable investing in the Indian securities market.

What is Tickertape?

Tickertape is a stock analysis platform for the Indian stock market that offers many advanced tools to take your investment strategy to the next level. The platform helps you with comprehensive stock analysis backed by prebuilt and custom stock screeners, stock forecasts, company reports, a market mood index indicator, advanced watchlists, and portfolio analysis.

Often, stock analysis gets overly complicated, especially when you have to switch between various stock analysis platforms. However, with Tickertape, you have all the essential tools in one place. Using the platform can reduce market risk for your investments by helping you invest in the best stocks at the right time. The best part is that you can use this tool with any Demat account.

How to Use Tickertape Tools

Screeners – Prebuilt and Custom

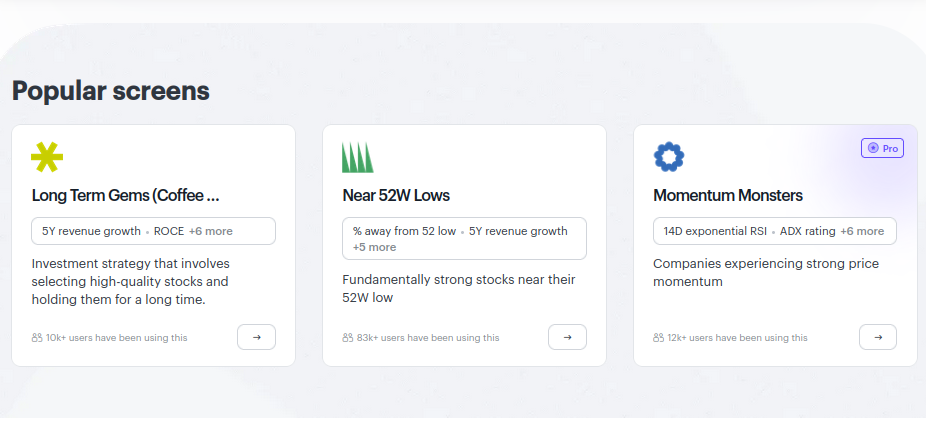

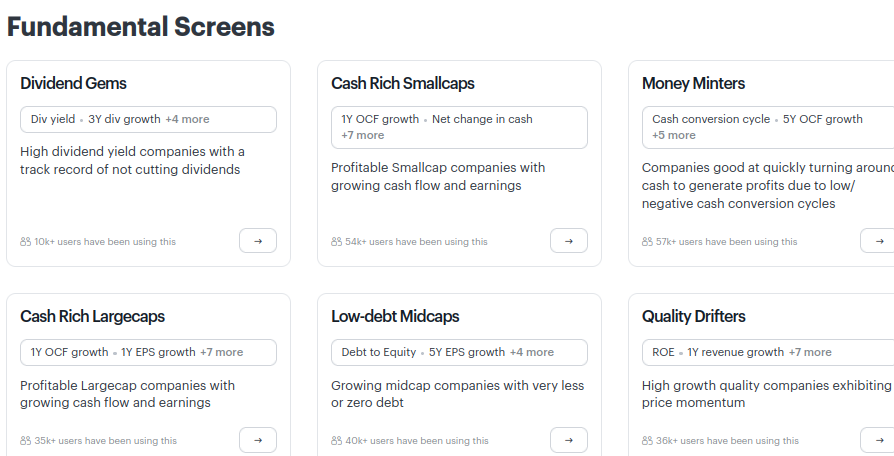

Tickertape has an extensive library of screens including Popular Screens, Fundamental Screens, Technical & Momentum Screens, and Futures & Options Trading Screens. Some popular screens are Long Term Gems, Near 52W Lows, Momentum Monsters, and Dividend Gems.

To use a prebuilt Tickertape stock screener or a Tickertape mutual fund screener, you must click on the Screeners tab. Next, you can select a convincing screener and pick up one or more stocks from its list to invest. It's not hard to imagine how quick and easy it is to select fundamentally strong stocks or the best high liquidity stocks with these screeners.

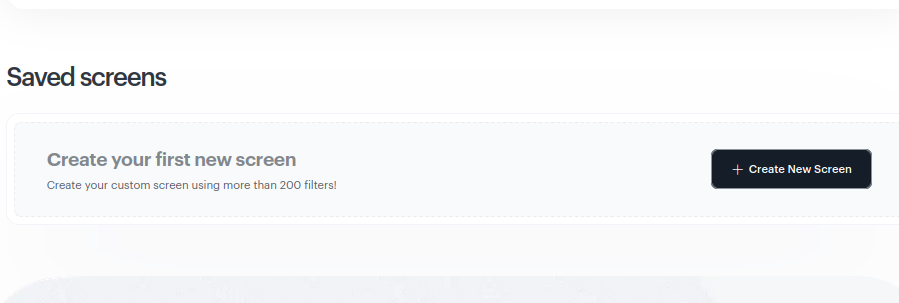

The platform also allows you to create custom screeners. To create your own screen with your desired filters, you only have to click on the Screener tab and get down to the Option, Create New Screen. Next, you must click on Add Filter, which will display various filters to choose from, like market cap, volume, 52-week high, etc. You can select your desired filters and click on Done. Now, the screener will automatically pick stocks based on your filters.

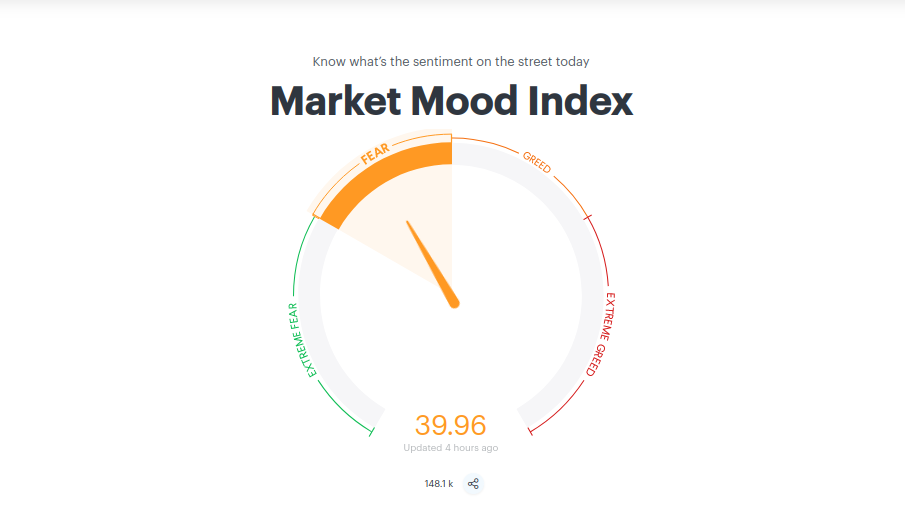

Market Mood Index

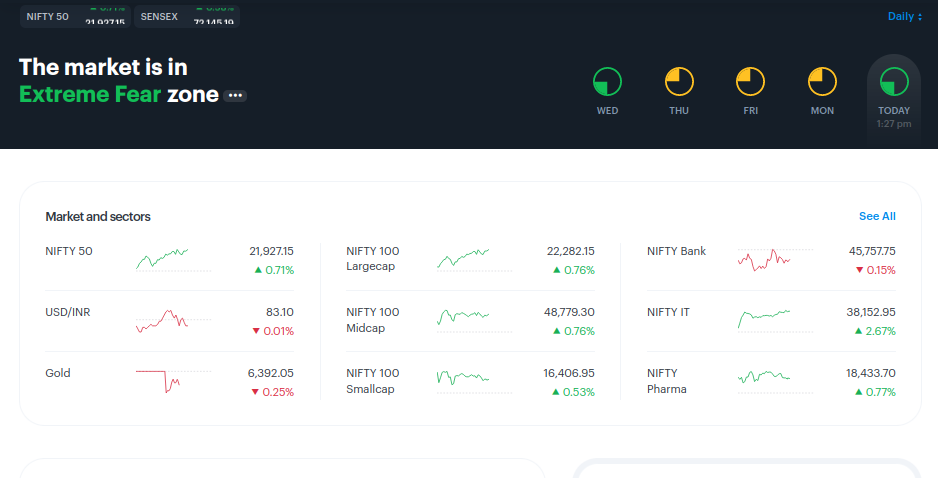

Tickertape's Market Mood Index tool is another valuable tool for Investment. Time plays a huge role in investments, and if you mistakenly invest when there is fear in the market, chances are that you will make a huge loss. Hence, you need to be perfectly aware of the market mood before entering a position. Tickertape's Market Mood Index has four moods – Fear, Greed, Extreme Greed, and Extreme Fear.

One way to look at share market investing is as a game of fear and greed. Hence, if the Market Mood Index is lower than 20″ it's considered Extreme Fear, with the market being Oversold. It is a perfect time for entering fresh positions. On the contrary, when the MMI is above 80, it's considered Extreme Greed. It's advisable to avoid entering any fresh buying positions since the market is Overbought. You can hover over More and click Market Mood to use it.

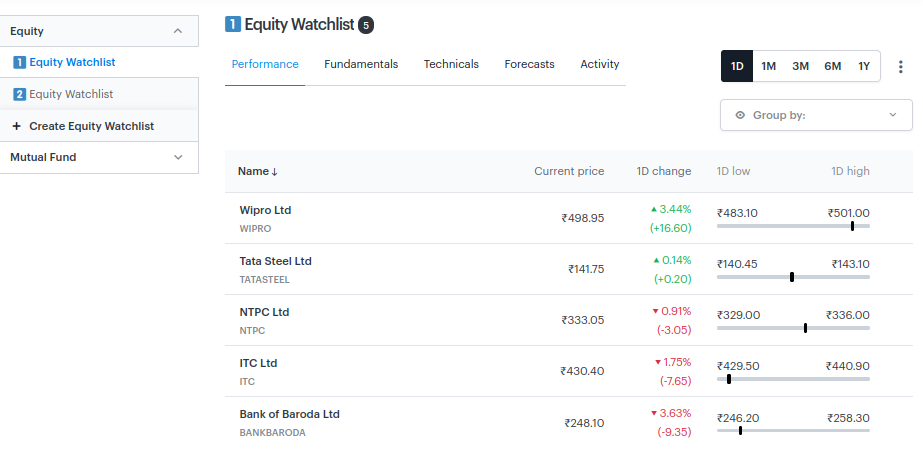

Watchlist

It's always wise to track some stocks before investing in them, and this is where a Watchlist comes in handy. Tickertape allows you to create watchlists for Equity and Mutual Funds. To create a watchlist on Tickertape, you need to hover over More and click on Watchlist.

After you get to the Watchlist page, you can click Create Watchlist and add various companies, ETFs, or indices to track their performance. To add a stock, you must search for the stock symbol. Further, Tickertape watchlists come with advanced features such as Scoreboard, which gives you an excellent overview of a stock's performance, valuation, growth, and profitability.

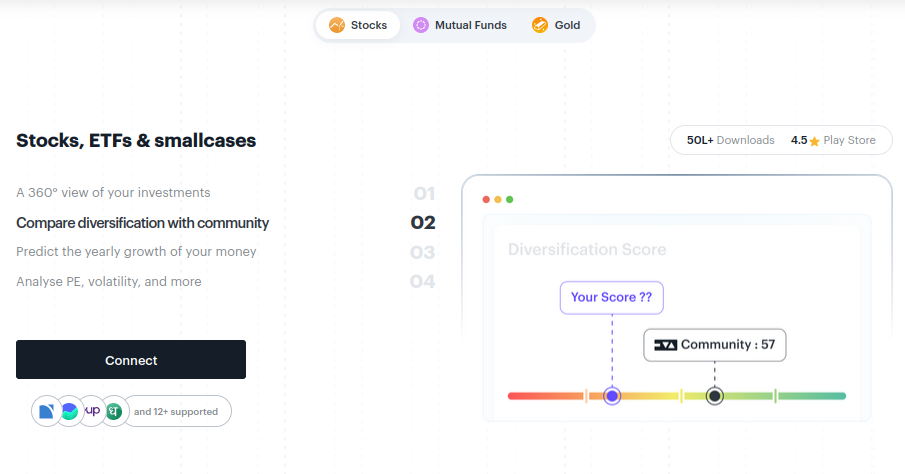

Portfolio Analysis

Another handy tool is the Portfolio Analysis tool by Tickertape. Using this tool, you can quickly evaluate the profitability of your Stock Portfolio. The tool gives a 360-degree view of your investments by comparing diversification with community. Besides, it analyzes PE, volatility, and yearly growth of your money. It's always wise to analyze your Portfolio from time to time to check its strengths and weaknesses.

You can analyze your Portfolio anytime using Tickertape's Portfolio tool and make the necessary adjustments to increase its profitability. You can connect your broker platform to Tickertape for a Portfolio Analysis. Tickertape supports all the leading broker platforms such as Zerodha, Groww, Upstox, and Dhan.

Stock Deals

Now, this can be an extremely powerful tool if used correctly. The Stock Deals tool displays stocks with large buying and selling volumes by Institutional investors. Markets are driven by institutional investors, promoters, and big mutual fund houses, while retail traders and investors can only participate in the rally.

It's crucial to understand that retail investors can't move the market. Hence, it's always wise to sync your trade with market movers. Using the Stock Deals tool can help you easily determine the actual direction of the stock and create early positions at the best stock price.

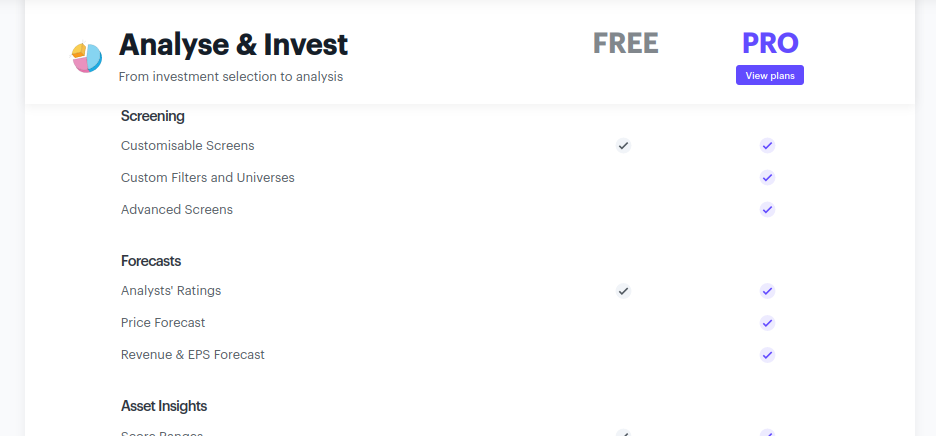

Tickertape Free Vs. Pro

While Tickertape seems to be a very powerful stock analysis platform with many advanced features, some of its features are only available in the Pro version. Forecast and Performance Tiers and Diversification Score And Redflagged Assets are only available in the Pro version.

The free version also lacks the Custom Filters feature and does not include Price Forecast, Revenue Forecast, or EPS Forecast features. Switching to the Pro version will also help you have an ad-free experience.

Tickertape Pro plans

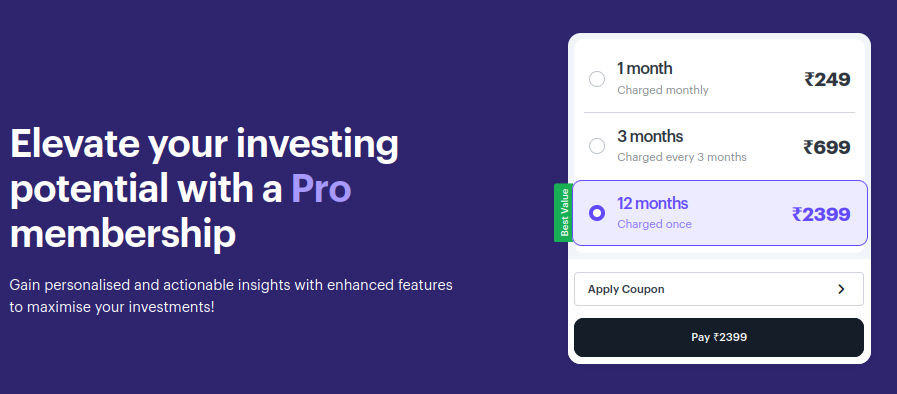

Tickertape has different payment options for its Pro version. You can get it for ₹249 for one month (charged monthly) or ₹699 for three months (charged every three months). The platform also allows you to have a Pro Membership for a lifetime, paying a one-time fee of ₹2399.

Conclusion

Tickertape is a less complicated yet powerful stock analysis platform. Even if you are an absolute beginner in the stock exchange, you should get the hang of this platform really fast to select stocks.

The platform has excellent tools for comprehensive stock analysis and profitable investing. The free version should be fine for most people. However, as an investor, you can upgrade to Pro if you ever need to use all the advanced features such as Custom Screener, Price Forecast, etc.