It’s certainly not a good feeling when you look at your PNL at the end of the year and realize that a big chunk of your profit has been spent on paying brokerage. Another way of seeing it is from the perspective of an absolute beginner. While most beginners have no control over overtrading, they eventually pay a lot of money as a brokerage.

As a trader, you must strive to save your capital since you can only keep trading if you have your capital intact. However, what if I tell you that you can trade without paying any brokerage? Don’t be surprised, as it’s absolutely possible.

This post will walk you through the four best zero brokerage demat accounts. Most importantly, I will share the pros and cons of these four brokerage trading platforms, and hopefully, you will find the right demat account for your trading requirements by the time you reach the end of the post.

Zero Brokerage Demat Account

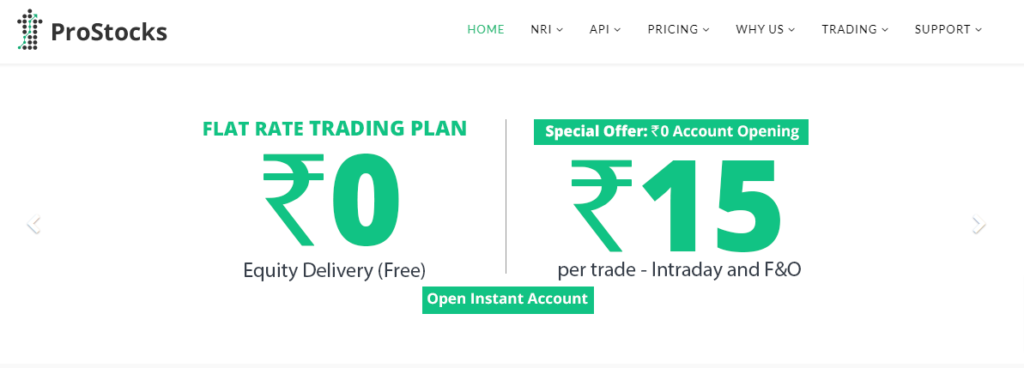

1. ProStocks

ProStocks was founded in 2016 and is a reliable trading platform that provides customers with equity and F&O trading segments. The platform offers brokerage-free equity delivery trading. Besides, ProStocks comes with a free account opening and a Lifetime AMC Free Demat account.

Further, ProStocks allows customers to choose between its two Unlimited Monthly Plans for unlimited zero brokerage trading. As far as the application goes, ProStocks provides customers with a mobile trading app and website for trading.

Features

- Zero Brokerage on Equity Delivery Trading

- Free Paperless Account Opening

- Lifetime AMC Free Demat Account

- Website, Free Trading Terminal, and Mobile Trading App

- Unlimited Trading Plans for Equity and Currency

Pros

- Zero Account Opening Charges

- Zero Account Maintenance Charges for a lifetime with a one-time refundable deposit of Rs 1000

- ProStocks comes with Demat and Trading account.

- Unlimited Trading with Zero Brokerage plan for Equity and Currency

- The Flat Fee Plan comes with Rs 15/trade for Equity & F&O, which is lesser than Zerodha or Upstox.

- Offers the cheapest Algo trading

- Free trading application across PC, web, and mobile

Cons

- Not a 3-in-1 account model since it comes with only a demat and trading account

- Lacks Commodity Trading

- The chart is lagging sometimes

- NSE SME IPOs are not supported

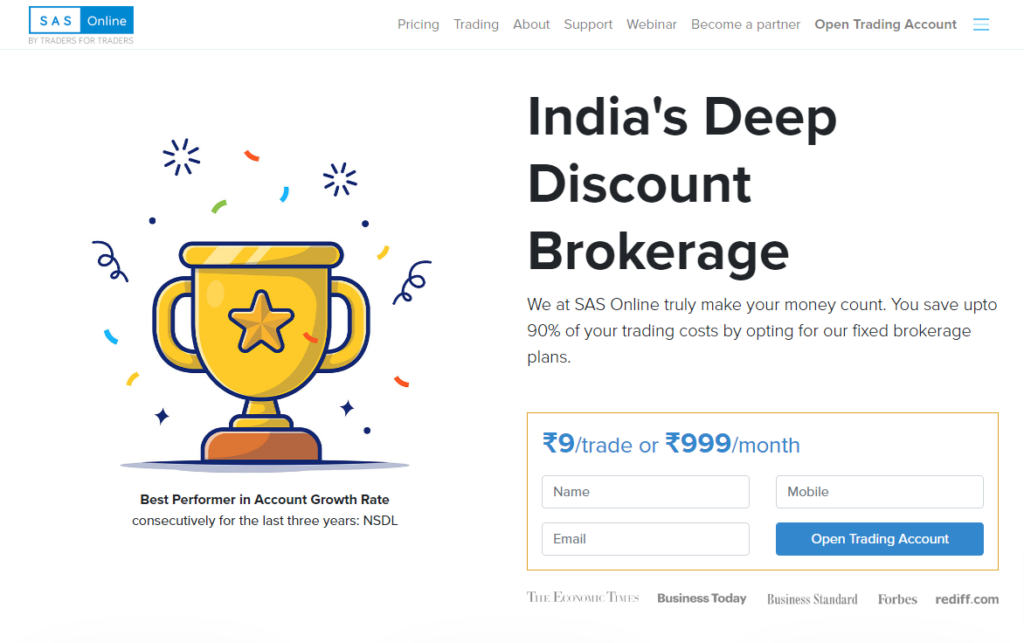

2. SAS Online

SAS Online was established in 1995 and is a less-known yet decent Discount Brokerage platform in India. The platform claims to be India’s Deep Discount Brokerage platform, wherein traders can save up to 90% of their trading costs.

SAS Online allows you to trade in Equity, FNO, Currency, and Commodity segments and comes with decent trading applications with a superb trading experience across the web, mobile, and desktop. The platform charges a Demat Account opening charge of Rs 200 and an Annual Maintenance Charge of Rs 200 for Individuals and Rs 500 for Non-Individuals.

Features

- Demat Account opening charge of Rs 200

- Annual Maintenance Charge of Rs 200

- Supports Equity, FNO, Commodity, and Currency segments

- Trading apps across all device platforms

- Four pricing to choose from

- Zero brokerage on Equity delivery and Rs 9 per trade on Equity Intraday, FNO, Currency, and Commodity

Pros

- Charges a brokerage of Rs 9 per trade, while most other brokers charge Rs 20 per trade

- Unlimited plan with zero brokerage for MCX, Equity, and Currency available for a monthly pricing

- Free trading applications on desktop, web, and mobile platforms

- It comes with Alpha Trader for advanced charting

- Margin funding through Equity Plus

Cons

- Good Till Canceled (GTC) is not available

- Not a 3-in-1 account

- No Python API for Algo trading

- Visit SASonline.in for current pricing

- Or read our full review on SAS Online

3. m.Stock

m.Stock by Mirae Asset is a trading platform that started in 2023. A platform is a good option for anyone looking for brokerage-free trading for a lifetime. m.Stock allows customers to trade and invest in stocks, FNO, currency, mutual funds, and IPO. Customers also have the advantage of the eMargin feature with m.Stock.

The broker offers decent trading apps across the web and mobile. Besides, it comes with Smart calculators and Fundamental & Technical Data. Most importantly, m.Stock puts a lot of emphasis on helping customers with super fast orders.

Features

- Zero brokerage on all trading & investment products

- Smart, secure, and superfast charting tools

- Easy-to-use interface

- Supports IPO, Stocks, Mutual Funds, FNO, and Currency

- Customizable risk management and Intuitive reporting system

Pros

- Zero brokerage for life across all products for a one-time cost of Rs 999

- Free AMC for a lifetime for a one-time fee of Rs 999

- Zero brokerage on Delivery, Mutual Funds, and IPO for a one-time fee of Rs 149

- Excellent charting tool across the web and mobile platforms

- Good Customer Support and Knowledge Center

- Fund deposits and withdrawals are super simple

Cons

- AMC is not zero unless you pay a one-time fee

- No offline presence

- No option for trading in agricultural commodities

- Some occasional glitches in its app noticed

- Visit Mstock.com for current pricing

- Or read our full review on M.Stock

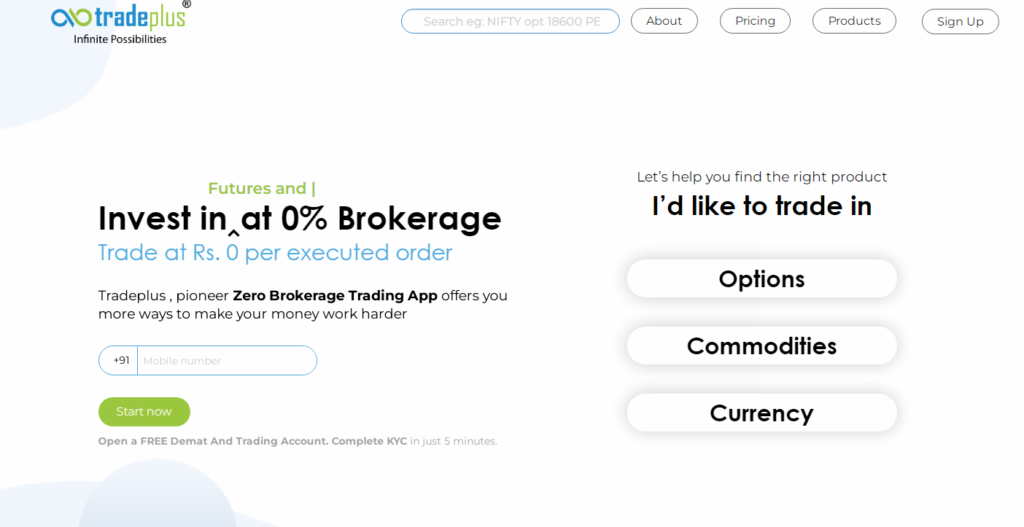

4. Tradeplus

Tradeplus is a SEBI-registered trading platform that has been around since 1995. The platform allows users to trade in Equity, FNO, Currency, and Commodity. Customers can open an account with Tradeplus entirely online in just 5 minutes.

Tradeplus comes with zero account opening charge and zero Annual Maintenance charge. As far as the charting application goes, Tradingplus has cutting-edge trading platforms across the web, mobile, and desktop.

Features

- Zero Account opening charge and zero AMC for lifetime

- Supports Options, Commodities, Currency, and Margin Trading

- Supports Mutual Funds and IPOs

- Zero brokerage on Equity Delivery

- Rs 9 per trade on Equity Intraday

- The charting app is well-designed and intuitive

- Zero brokerage Derivative trading plans for all segments

- Call and Trade facility available for Rs 75 per day

Pros

- Zero account opening charges & zero AMC

- Zero brokerage on Equity Delivery

- Powerful charting tools across all device platforms

- Free Derivative Trade for Rs499 per month with the FLAT PRO plan

Cons

- Poor customer support

- The user interface is not as friendly as Zerodha or Angel Broking

- Charges Rs 120 per month for sms alert

- The trading software has glitches sometimes

- Visit Tradeplus.com for current pricing

- Or read our full review on M.Stock

5. Zerodha

When talking about zero brokerage, it's always incomplete without mentioning Zerodha since the online broker introduced the concept of zero brokerage in 2010. The concept has helped Zerodha beat the popularity of online brokers like Sharekhan and ICICI Direct back then.

Zerodha has excellent reliability, features, and an exceptionally clean interface. Zerodha has been there for over 13 years and continues to be India's finest online trading platform. The trading platform charges ₹200 for account opening and ₹300 per year for Annual Demat Account Maintenance.

Zerodha has zero brokerage charges for Equity Delivery and Mutal Fund Investments. The platform charges a Flat ₹ 20 or 0.03% (whichever is lower) per executed order on all segment Futures and a Flat ₹20 on all segments Options.

Features

- ₹200 for account opening & ₹300 per year as AMC.

- Clean and easy-to-use interface.

- Excellent applications across the web and mobile devices.

- Advanced Charting tools: Tradingview and ChartIQ

- Multiple order types: GTT, BO, and CO.

- Excellent technical analysis tools: Streak and Sensibull

- Order execution is fast.

- Reliable and friendly customer support through tickets and phone.

Pros

- The Zerodha Kite app is equally reliable on web and mobile platforms. The interface is super clean and intuitive.

- users can choose between Tradingview and ChartIQ.

- Advanced order types like GTT.

- The Streak application is entirely free on Zerodha.

- Sensibull is also free for backtesting.

- Dedicated and friendly customer support team.

Cons

- Account opening is not free.

- No Live Chat support.

6. Upstox

Upstox was launched in 2009 and, ever since, has been a reliable trading and investment platform. We included Upstox in our list of Zero brokerage demat accounts in India since it offers zero brokerage on Mutual Funds and IPOs. You can open an account with Upstox for Zero charges. Besides, AMC is as nominal as ₹150 in Upstox.

Upstox has highly usable applications for web and mobile platforms. Upstox applications come with advanced charting, multiple order types, and watchlists. Most importantly, Upstox offers fast order execution and comprehensive customer support.

Features

- Zero charges for account opening.

- AMC as nominal as ₹150 per year.

- Excellent trading applications with advanced charting tools.

- Advanced order type like GTT.

- Quick order execution.

- Comprehensive customer support through live chat, phone, and tickets.

- Sensibull Integration.

- Ready-made Options strategies.

- Excellent market overview and comprehensive Options data.

Pros

- No account opening charges.

- Nominal AMC.

- Tradingview and ChartIQ charting tools.

- Multiple order types, including GTT.

- Fast order execution.

- Ready-made Options Strategies.

- Sensibull Integration.

- Ready-made Options Strategies.

- Excellent Customer Support.

Cons

- Equity Delivery is not brokerage-free.

7. Angel One

Angel One certainly deserves a mention in this post since it has zero brokerage charges on Equity Delivery. Angel One allows customers to open an account for zero costs. The platform charges an AMC of ₹240.

The platform is extensively used in India, with advanced charting tools and multiple order types. However, Angel One's customer support is less responsive, and that's the reason I chose to avoid this platform.

Features

- Zero account opening charge.

- AMC is ₹240.

- Zero brokerage on Equity Delivery.

- Advanced trading applications, including Desktop Software.

- Advanced charting tools.

- Multiple order types.

- Excellent research and analysis service.

Pros

- No charges on account opening.

- Equity Delivery is brokerage-free.

- Reliable trading applications, including Desktop Software.

- Multiple order types.

- Top-notch research and analysis data.

Cons

- Customer support needs to improve.

Zero Brokerage Demat Account FAQs

What are some of the good zero brokerage demat account platforms in India?

If you are tired of paying brokerage on trading, you can try a zero brokerage plan on any reliable trading platform. Here are four decent zero brokerage demat account platforms:

- ProStocks

- SAS Online

- m.Stock

- Tradeplus

How much does m.Stock Zero Brokerage plan cost?

m.Stock is a new yet reliable trading platform, and the platform offers you brokerage-free trading for a lifetime for a one-time charge of Rs 999. Besides, the platform allows customers to get rid of AMC forever by paying a one-time charge of Rs 999. The platform comes with powerful and intuitive trading tools and good value for money.

Conclusion

Opening a Zero Brokerage Demat Account can help you cut down on trading expenses to a large extent. However, you must choose a zero brokerage demat account platform wisely and ensure it has the right features for you. I have walked you through 7 of the best zero brokerage demat account platforms. You can choose the right platform depending on your trading and investing requirements.

However, it's important to understand that none of these Zero Brokerage platforms are as reliable as Zerodha or Upstox. Most importantly, you must ensure that you don't over-trade and hamper your money management.