If you need to open an account with Zerodha but are not quite sure how to go about it, you have come to the right place. In this post, I will walk you through all the essential steps that you need to follow how to open a Zerodha account

Read our full review of Zerodha

Zerodha Account Opening Process

Opening an account with Zerodha is easy, and here are the steps you need to follow in order to open an account with Zerodha:

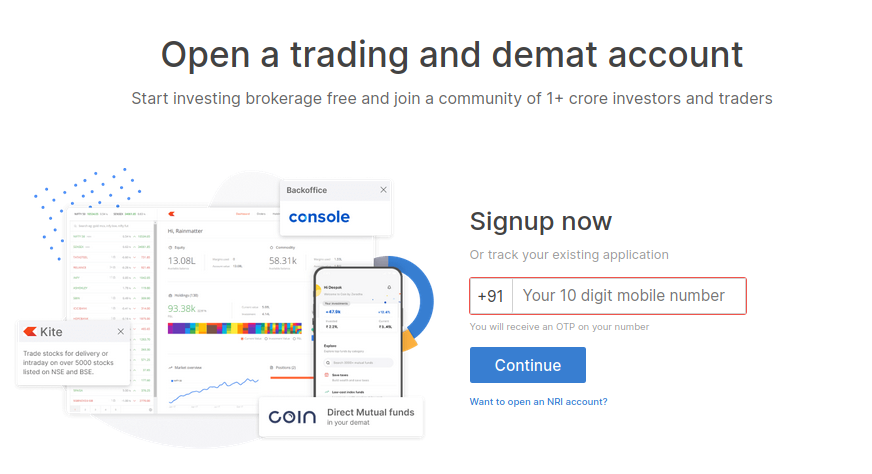

- First, you must get to the Zerodha official website. Next, you can click the Sign up now button and enter your mobile number. It would be better if you entered your Aadhaar-linked mobile number.

- After that, you will receive an OTP to your mobile number, and you will need to enter the OTP on the Zerodha Mobile OTP field to verify your mobile number.

- On the next page, you must enter your Name and Email. After you enter the details, you can hit the Continue button. However, you must ensure the entered name matches exactly with the name you have on your ID proof.

- You will receive an OTP to your Email account to verify your email ID with Zerodha. You must enter the OTP into the Email OTP field on the Zerodha page.

- Next, you will need to enter your PAN Card Details and Date of Birth. Once entered, you can hit the Continue button.

- After that, you will need to pay the account opening fee through UPI, Card, or net banking. To proceed, you must click the Pay & Continue button.

- After your payment is verified, you will be directed to the Aadhaar KYC (DigiLocker) page, and to proceed, you will need to press Continue to DigiLocker.

- After that, enter your Aadhaar card number and hit the Next button. An OTP will be sent to your Aadhaar-linked mobile number, which you must enter in your DigiLocker OTP field to verify and hit the Continue button.

- Next, you are directed to the Your Profile page, wherein you need to specify your Marital status, Parents' name, Income slab, Fund and security settlement preference, Occupation, and trading experience. Once you fill in the details, you can hit the Continue button.

- On the next page, you will link your bank account by entering your Bank account number and IFSC. After entering the required details, you must scroll down the page, read and tick on all the terms and conditions, and hit the Continue button again.

- The next step is Webcam verification, and you need to enable your device's camera. You will be assigned a number on that page, which you need to write on a piece of paper, just as in the example given on the page, and holding the paper, you need to capture your photo and hit the Confirm button.

- Once IPV is done, you must upload the essential documents, such as your six months' bank statement as income proof (for F&O and Commodity segments), the image of your signature, and a copy of your PAN. After uploading, you can hit the Continue button.

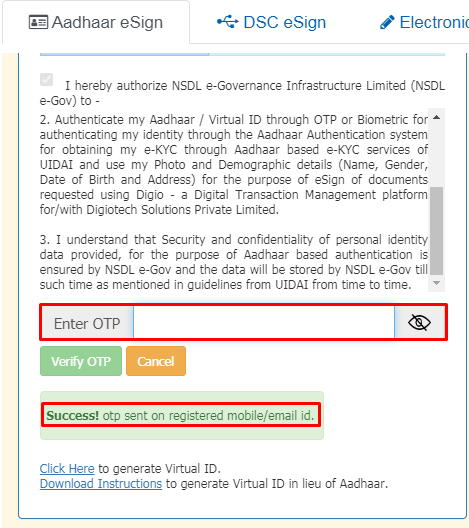

- After that, you will need to eSign your form, and for that, you will need to click on the eSign button and then Proceed to eSign.

- It will redirect you to the NSDL eSign website. You will need to check the terms and conditions and enter your Aadhar card number. Next, you will hit the Send OTP button.

- You will receive an OTP to your Aadhaar-linked mobile number, which you must enter in the Enter OTP field on the NSDL eSign website and click the Verify OTP button.

- After that, you will be redirected to Zerodha, and you can hit the Finish button. Besides, you will see the Congratulations message.

- Next, you can wait for your Zerodha credentials to be emailed to your email inbox in 24 to 48 hours.

Zerodha Charges

I have explained the steps you require to follow to open an account with Zerodha. However, before opening the account, it's essential to familiarize yourself with Zerodha charges. Zerodha charges an account opening fee of ₹200 and a Demat Annual Maintenance fee of ₹300.

Next, it's essential to look at the Zerodha brokerage structure. Here are the Zerodha brokerage charges for various segments:

- ₹0 brokerage charge for Equity Delivery and Direct Mutual Fund

- Flat ₹20 or 0.03% (whichever is lower) per executed order for Equity Intraday and All Segments Futures

- Flat ₹20 per executed order for Equity for All Segments Options

Conclusion

If you are a beginner and have decided to open an account with Zerodha, you have certainly made the right decision since Zerodha is the most reliable and ideal platform for all levels of users.

Account opening may seem intimidating, but with our guide, you should be able to open a Zerodha account flawlessly. Besides, I have walked you through the various charges of the platform. Hence, you can now go about the account opening process confidently.