Dhan and Zerodha are two leading trading platforms in India.

If you have difficulty choosing between the two platforms, Dhan and Zerodha, reading this post will help.

In this Dhan Vs Zerodha post, I will explain the history, features, trading applications, and fees and charges of the two companies.

It should provide you with clarity on the two trading platforms.

Summary:

- Dhan, as a new service, offers a free demat account with no AMC charges. It's cheaper to get started when compared to Zerodha.

- Zerodha has been in the industry for 13 years. So their products comes with lesser bugs and their Kite app is stable. On the other hand, Dhan, which is a new service is facing multiple bugs are reported by users.

- Based on my expertise, I would suggest Zerodha as a reliable trading app that can provide a hassle-free experience. On the other hand, if you are looking for a more cost-effective option, Dhan could be a good choice.

Dhan Vs Zerodha – Introduction

Dhan

Dhan started in 2021 and is a lightning-fast platform for investing and trading.

Interestingly, the platform emerged as a popular trading platform within a quick span of time.

Many people see Dhan as a good competitor of Zerodha.

The Dhan CEO, Pravin Jadhav, started the company to raise the bar for financial services in India and to help Indians build wealth.

The platform uses cutting-edge technology to make things more innovative and convenient for traders and investors.

Dhan is backed by many leading investors, such as Mirae Asset, Social Leverage, Whiteboard Capital, Rocketship.vc, and Blume.

Most importantly, the platform offers a wide variety of products for investment and trade.

One thing which is very commendable about the platform is the fact that it continues to be a spam-free and reliable trading platform with no calls, no SMS, and No Data Sharing.

Zerodha

Zerodha was started in 2010 by Nikhil Kamath and is one of the finest discount brokers in India.

Zerodha is also the largest stock broker in India.

The platform has robust technology to make things easy and effective for traders and investments.

The platform won the top prize at the sixth edition of The Economic Times Startup Awards in 2020 for being a bootstrapped startup yet profitable. The platform is equally ideal for both investors and traders.

Zerodha Vs Dhan Trading Platform

Dhan Trading Platform

Dhan has comprehensive trading tools to take your investment and trading to the next level. The Dhan app is available on the web and mobile platforms.

The app is ideal for investment and trading, characterized by a clean and fast interface. The app also comes with real-time news and fast fund withdrawals for FREE.

The app has salient features such as high-end encryption, direct trade from charts, multiple watchlists, price alerts, and a brokerage calculator.

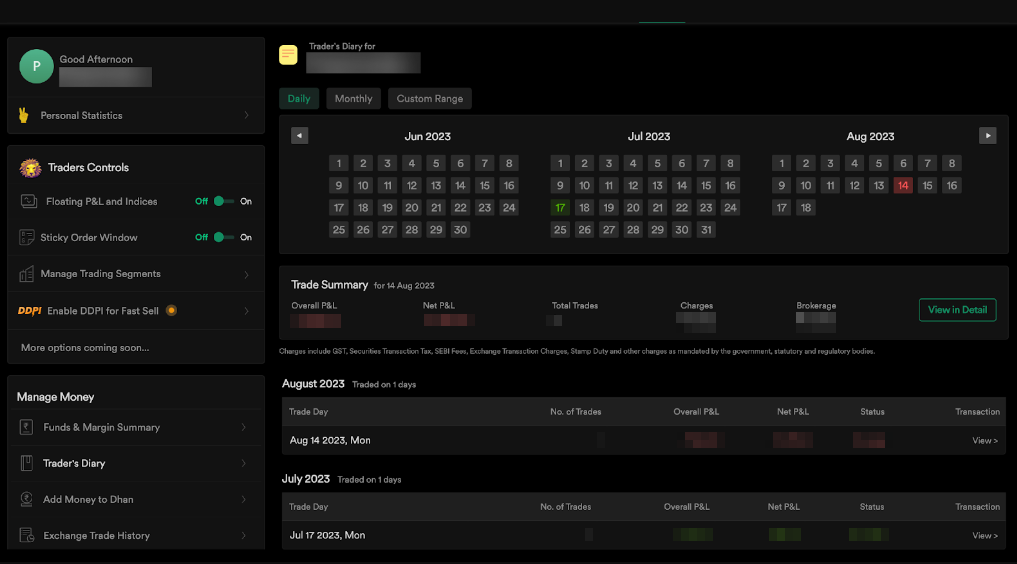

One innovative feature of Dhan is the Trader's Diary, which allows traders to view their PNL as well as record their trading experience in the form of notes.

Besides, Dhan has a dedicated application for Options traders, and interestingly, it has named its application Options Trader, which is available on mobile and web platforms.

The Options Trader app comes with some handy features for F&O traders, such as readymade F&O trading strategies, a Pay graph, and a risk/reward profile.

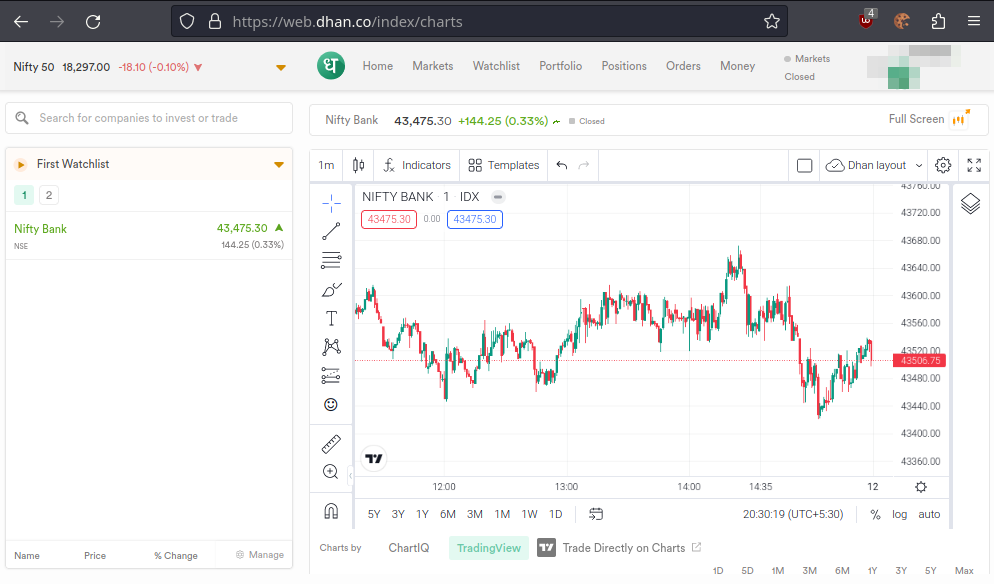

As far as charting goes, Dhan comes with a built-in Tradingview chart, allowing traders to punch orders directly from the chart.

Further, Dhan allows users to connect their accounts to external Tradingview charts. DhanHQ Trading APIs are another impressive feature that is worth mentioning.

The feature helps you connect the APIs with many major Algo trading platforms, Banks, Stock Brokers & Portfolio Managers, and Fintechs. Hence, Dhan can be a decent platform for Algo trading as well.

Dhan Smallcases is a nice feature for long-term investors, and the feature helps users build long-term investment plans curated by SEBI-registered professionals.

Most importantly, the feature can help investors with varying needs, such as low volatility, low investment amount, thematic investment, or tracking sectors.

I also went through the views of some Dhan users; interestingly, most users think the trading platform is fast and clean.

Zerodha Trading Platform

Zerodha has comprehensive trading tools.

Zerodha's trading application is called Kite, which is available for free on mobile and web platforms. Kite allows users to choose between Tradingview and ChartIQ charting.

Kite come with different order types and timeframes. Apart from Kite, Zerodha also has its reporting dashboard called Zerodha Console to monitor your investments and various reports, including PNL.

Zerodha Coin is Zerodha's Mutual Fund Investment. Further, Zerodha comes with Smallcase for thematic investment, and the platform also has Streak to backtest trading strategies. Streak is entirely free for Zerodha users now.

Besides, Zerodha allows customers to integrate their accounts with Sensibull, which is an options trading platform. Users can compare strategies, evaluate profitability, and understand risks using Sensibull.

Dhan Vs Zerodha – Products and Services

Dhan Products & Services

It's time to walk you through the Dhan Products. Dhan offers excellent investment and trading products.

The platform provides customers with trading and investment products such as Stocks, F&O, Commodity, Currency, IPO, and ETFs. The platform also offers Call & Trade facility for Rs 50/order+GST.

Zerodha Products and Services

Zerodha is ideal for all types of investors and traders. The platform allows customers to trade and invest in stocks, IPOs, Futures and Options, Commodity derivatives, Currency derivatives, Direct mutual funds, and Bonds and Govt. Securities.

Dhan Vs Zerodha – Fees & Charges

Dhan Fees & Charges

Next, we look into the various fees and charges of this platform.

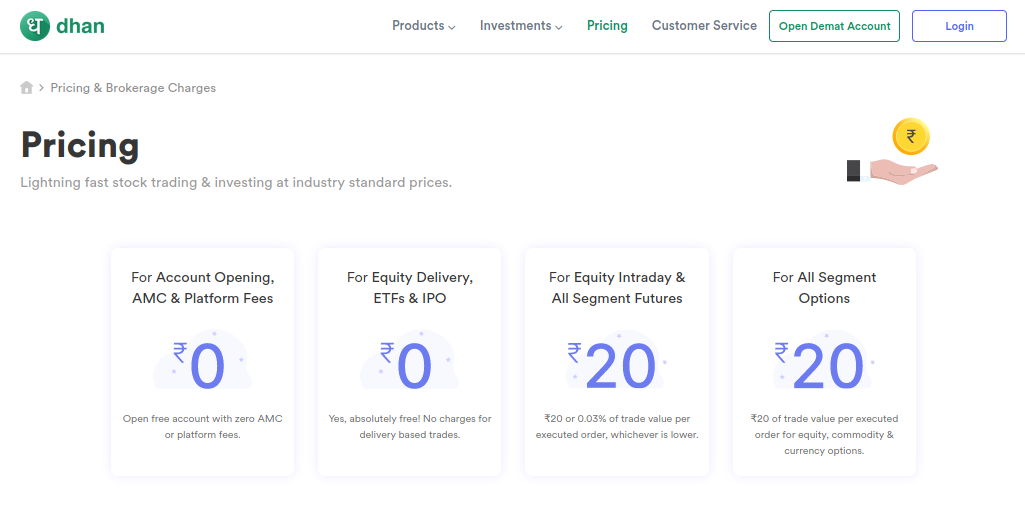

Dhan doesn't charge any account opening fee. Besides, it doesn't charge any AMC, unlike Zerodha.

The brokerage structure is the same as Zerodha – Zero brokerage for Equity Delivery, & Rs 20 for Equity Intraday and All Segments Futures and Options. The platform charges zero brokerage on ETFs and IPO.

Zerodha Fees & Charges

Unlike Dhan, Zerodha charges Rs 200 for account opening and an AMC of Rs 300 per year.

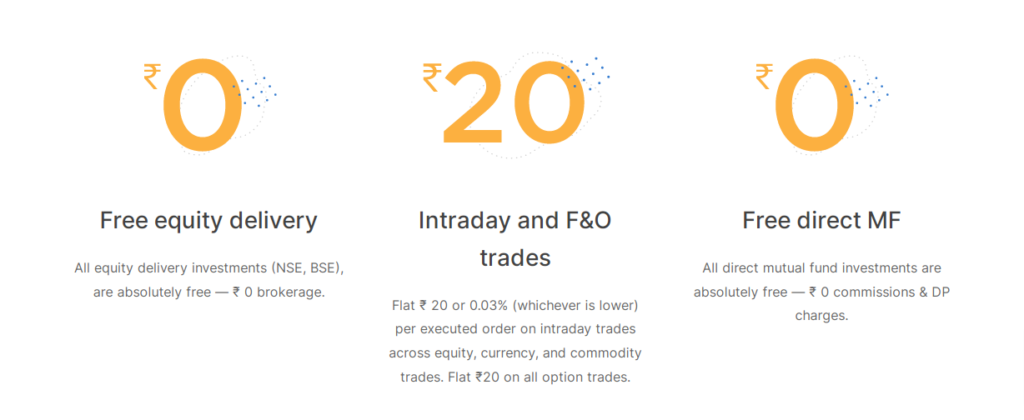

The platform has zero brokerage charges on Equity delivery and Flat Rs 20 or 0.03% (Whichever is lower) per executed order for Equity Intraday, F&O, Currency, and Commodity.

Zerodha has zero brokerage charges on Direct Mutual Funds.

Dhan Vs Zerodha – Customer Support

Dhan Customer Support

Finally, it's time to look at Dhan's Customer Support Service.

Dhan has excellent customer support service in place to assist the customers. Dhan's customer service comprises Live Chat, Email, and Phone support.

Besides, the platform has an excellent Dhan Community, @DhanCares on Twitter, and a decent knowledge base.

Zerodha Customer Support

Zerodha offers reliable customer support through tickets and phone calls. Besides, the platform allows customers to browse help topics from its knowledge base.

However, if I compare the Zerodha Customer Support with the Dhan Customer Support, the Zerodha Customer Support is more responsive on Phone and Email Support.

Dhan Vs Zerodha – Conclusion

I have walked you through the various aspects of Dhan and Zerodha in this post.

As you have seen, both trading platforms are highly reliable you can be confident in the reliability and convenience of their respective demat account services.

Many experts have already started seeing Dhan as an excellent competitor to Zerodha.

One killer feature of Zerodha, which makes it the favorite trading platform among day traders, is its impressive P&L report. However, Dhan takes it one step further with almost the same P&L report with an option to record trading notes. Altogether, it works like a nice trading journal for traders.

Another advantage customers have with Dhan over Zerodha is that Dhan offers APIs for free while Zerodha charges an additional price for its APIs.

Further, Dhan has zero charges on account opening and zero AMC, unlike Zerodha.

However, the biggest issue with Dhan is the new platform. Think of Zerodha, which was founded in 2010, which might be got a lot of bugs. But eventually, they fixed most such bugs as they are 13 years in the industry.

In the same case, consider Dhan, which was founded in 2021, has a lot of bugs now, and it will take some years for the product to get stabilized. Till then, if you want a error-free trading experience, Zerodha is the best option to get started. Most importantly, while Dhan has a feature-rich interface, which may seem to be little complicated for beginners, Zerodha has the cleanest and most intuitive interface.

The article clearly explained all major important points which extremely helpful to choose between Dhan and Zerodha as per individual requirement. I thank Somen Bhattacharjee for his research to place this article to us.